That moment arrives when a seemingly advantageous acquisition reveals its true, hidden cost. Perhaps it’s a new server, initially boasting an attractive price tag, a veritable steal compared to its competitors. Yet, the subsequent power bills, the relentless cooling expenses, the unending maintenance contracts, and the per-user, per-month software licenses quickly transform that initial ‘great deal’ into a financial quagmire, draining resources never accounted for in the initial budget. This scenario vividly illustrates the brutal reality of neglecting the total cost of ownership (TCO).

It is a common pitfall, one frequently observed in real-world scenarios across various industries. Focusing exclusively on the upfront sticker price is a direct path to financial regret. To make genuinely smart, results-driven purchasing decisions—whether for a burgeoning enterprise or personal assets—a comprehensive understanding of an acquisition’s full financial lifecycle is not merely advantageous, but essential.

TCO: Beyond the Sticker Price

The sticker price, while an undeniable figure, is rarely the complete narrative. It represents nothing more than the initial acquisition cost, an entry fee into a far more complex financial landscape. The critical question then arises: What precisely is Total Cost of Ownership (TCO), and why does it fundamentally supersede the sticker price in importance?

The answer lies in TCO’s expansive scope. It meticulously encompasses every single cost associated with an asset throughout its entire useful life. This includes not only the initial acquisition but also the ongoing operational expenses, necessary maintenance, and even the often-overlooked costs of eventual disposal. To disregard these deeper, often hidden layers is to make decisions based on incomplete data, inevitably leading to unforeseen expenses and a significantly lower actual return on investment (ROI) than initially anticipated. It compels one to perceive the entire financial iceberg, rather than merely its visible tip.

Initial Costs vs. True Expenditure

Initial costs are, by their nature, straightforward: the purchase price, shipping, and perhaps basic setup fees. They are readily quantifiable and frequently become the sole focus of budget approvals. However, these upfront figures seldom reflect the asset’s true financial impact over its lifespan. Consider, for instance, a sophisticated piece of manufacturing machinery. Its purchase price might appear competitive. Yet, if its operation demands specialized, high-cost consumables, frequent and expensive maintenance interventions, or consumes excessive energy, its true expenditure will rapidly eclipse that initial number. The seemingly cheapest upfront option can, paradoxically, evolve into the most expensive long-term liability.

Hidden Cost Elements

A multitude of costs are not immediately apparent but accrue steadily over time, often beneath the surface of daily operations. These encompass critical aspects such as energy consumption, routine maintenance, essential upgrades, and even the often-underestimated cost of downtime should the asset fail. In the realm of software, one must consider recurring subscription fees, complex integration costs, and the ongoing expense of employee training. These hidden elements are precisely why a superficial glance at the price tag proves insufficient. They represent a substantial portion of an asset’s lifetime expense. A thorough total cost of ownership analysis for businesses is designed to unearth these elusive elements, thereby furnishing a clear and comprehensive financial picture.

TCO Components: Key Cost Categories

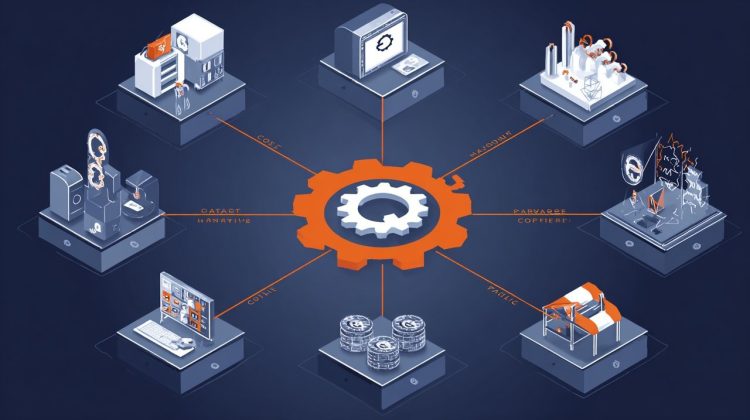

To fully grasp the mechanics of TCO, it is essential to deconstruct it into its constituent components. Each category contributes to the overarching financial burden or benefit an asset represents.

Acquisition Costs

These represent the most visible and easily identifiable costs. They include the actual purchase price of the asset itself, any applicable taxes, delivery charges, and initial installation or setup fees. For software, this might encompass the initial license fee or implementation costs. Beyond the direct purchase, it is prudent to consider any necessary ancillary purchases. A new server, for example, might necessitate specific racks, dedicated cooling units, or uninterruptible power supplies, all of which are integral to the initial acquisition phase.

Operational and Maintenance Costs

This category typically accounts for the largest and most persistent portion of an asset’s TCO, representing all expenses incurred during the asset’s active use. These ongoing expenditures are critical to sustain functionality and performance. Key examples include:

- Energy Consumption: Such as electricity for IT equipment or fuel for vehicles.

- Consumables: Items like printer ink, raw materials for manufacturing processes, or specialized fluids.

- Routine Maintenance: Encompassing scheduled servicing, inspections, and software updates.

- Repairs: Addressing unexpected breakdowns and the cost of replacement parts.

- Labor: Salaries for the staff operating or maintaining the asset, alongside associated training costs.

- Insurance and Warranties: Coverage against damage or extended support agreements.

End-of-Life Costs

These costs, frequently overlooked during initial planning, manifest when an asset reaches the culmination of its useful life. They can be surprisingly significant, particularly for large or potentially hazardous items. This category includes:

- Decommissioning: The process of safely shutting down and dismantling equipment.

- Disposal: Fees associated with recycling, landfill, or hazardous waste disposal.

- Data Migration: The crucial process of transferring data from older systems to newer ones.

- Resale Value: While not a direct ‘cost,’ the potential resale or salvage value should be factored in as a negative cost, effectively reducing the overall TCO.

Intangible and Opportunity Costs

These are arguably the most challenging costs to quantify, yet their impact can be profoundly significant. They represent the indirect consequences, both positive and negative, of owning or indeed, not owning an asset. Examples that illustrate their pervasive nature include:

- Downtime: The lost productivity and revenue stemming from equipment failure or scheduled maintenance.

- Security Risks: The financial and reputational costs associated with data breaches or system vulnerabilities.

- Lost Opportunity: The revenue or efficiency gains missed by selecting a less optimal solution, or the inherent cost of failing to invest in a demonstrably superior alternative.

- Brand Reputation: The potential damage incurred from unreliable products or services directly linked to the asset’s performance.

TCO Calculation: Practical Methodology

Calculating TCO extends far beyond merely aggregating obvious numbers. It necessitates a systematic and rigorous approach to capture all relevant costs, encompassing both direct and indirect expenditures. This foundational understanding is key to discerning how to calculate total cost of ownership effectively for practical, real-world application.

Data Collection and Scope Definition

The process commences with a clear definition of the asset in question and its projected lifecycle. Subsequently, all available data points related to its purchase, installation, and ongoing operations must be meticulously gathered. This often entails delving into invoices, scrutinizing utility bills, reviewing maintenance logs, and even analyzing employee time sheets. As a guiding principle, remember:

“If you can’t measure it, you can’t improve it. For TCO, if you don’t measure everything, you’re just guessing.”

The pursuit of data should be exhaustive. For a vehicle, for instance, one must not merely obtain the sales price; estimates for fuel consumption, insurance premiums, routine servicing, tire replacement, and projected resale value are equally crucial. The more granular and comprehensive your data, the more accurate and insightful your TCO analysis will ultimately be. Our Car Total Cost of Ownership (TCO) Calculator can provide invaluable insights for personal assets.

Quantifying Indirect Costs

This particular stage is where many TCO analyses prove deficient. Indirect costs, such as the productivity loss resulting from software glitches or the employee time consumed by manual workarounds, are inherently more difficult to pinpoint. It becomes imperative to assign monetary values to these impacts. For example, if a software system experiences ten hours of downtime per month, and each hour of lost productivity for your team equates to $100, that translates to an additional $1,000 per month in hidden costs. It is advisable to utilize reasonable estimates and industry benchmarks where precise figures are unavailable. One should not shy away from making educated assumptions; the overarching goal is to construct a more complete financial picture, not to achieve perfect foresight.

Lifecycle Cost Consideration

Crucially, TCO is intrinsically a lifecycle concept. It demands a perspective that extends beyond mere annual costs, projecting them across the asset’s entire expected lifespan. A server might possess a five-year lifespan, a vehicle ten years, and a building potentially fifty years or more. To facilitate accurate comparisons, it is often necessary to discount future costs to their present value, thereby accounting for the time value of money. This long-term view enables an “apples-to-apples” comparison between various options, even those with disparate upfront costs and varying operational expenses. A seemingly cheaper initial purchase might appear appealing, but its higher long-term operational costs could ultimately render it far more expensive over its entire lifespan.

TCO Application: Driving Informed Decisions and Real Returns

Understanding TCO is not merely an academic exercise; it functions as a potent instrument for strategic decision-making. The importance of total cost of ownership in purchasing decisions cannot be overstated, particularly when contemplating significant investments.

Strategic Procurement Advantage

For businesses, TCO analysis fundamentally transforms procurement from a purely transactional activity into a deeply strategic one. It empowers organizations to evaluate vendors and products not solely on price, but on their true long-term value. This analytical depth allows for the negotiation of more advantageous contracts, the optimization of resource allocation, and ultimately, the achievement of superior financial outcomes. Consider the comparison between two cloud service providers: Provider A offers lower monthly fees, but Provider B boasts superior uptime, enhanced security features, and more streamlined integration tools that could save your IT team dozens of hours monthly. A rigorous TCO analysis would likely reveal Provider B as the more cost-effective choice, despite its higher initial sticker price.

Long-Term Value Assessment

TCO inherently compels a long-term perspective, shifting the focus from immediate, often superficial, savings to the cultivation of sustainable value. It aids in identifying investments that, while potentially carrying a higher upfront cost, deliver significant savings or efficiencies throughout their lifespan, culminating in a far superior ROI. This long-range view is particularly critical for capital expenditures, where the asset is intended for use over many years. By meticulously factoring in all associated costs, one ensures that today’s critical decisions contribute positively to tomorrow’s bottom line, rather than inadvertently creating future financial burdens.

Avoiding Costly Mistakes

Perhaps the most compelling argument for embracing TCO is its capacity to prevent expensive blunders. A disregard for TCO invariably leads to unforeseen costs that can derail budgets, delay critical projects, and even profoundly impact overall profitability. It delineates the crucial difference between a calculated, prudent investment and a mere financial gamble. How many times have companies acquired the ‘cheapest’ software only to expend double its initial cost on customization, training, and ongoing support? Or procured a fleet of vehicles with low purchase prices but exorbitant maintenance requirements? These are classic manifestations of TCO failures. A rigorous TCO analysis serves as a robust defense against such pitfalls, ensuring that investments genuinely contribute to an organization’s enduring success.

Total Cost of Ownership, far from being a mere accounting term, stands as a strategic imperative. It encapsulates the discipline of perceiving the full financial reality of every acquisition, from its initial procurement through to its ultimate disposal. For any significant investment—be it enterprise software, a new vehicle, or specialized production machinery—a robust TCO analysis is not merely advisable, but non-negotiable. To genuinely optimize purchasing decisions and maximize long-term return on investment, mastering this comprehensive framework is essential for navigating the complexities of modern financial landscapes.

💡 Frequently Asked Questions

Total Cost of Ownership (TCO) meticulously encompasses every single cost associated with an asset throughout its entire useful life. This includes not only the initial acquisition but also ongoing operational expenses, necessary maintenance, and even the often-overlooked costs of eventual disposal, providing a comprehensive financial picture beyond just the sticker price.

Focusing exclusively on the upfront sticker price is a common pitfall that leads to financial regret and unforeseen expenses. TCO is essential because it reveals an asset's true financial impact over its lifespan, helping to avoid costly mistakes, make smarter purchasing decisions, and achieve a significantly higher actual return on investment.

TCO is typically broken down into several key categories: Acquisition Costs (purchase price, taxes, installation), Operational and Maintenance Costs (energy, consumables, routine repairs, labor, insurance), End-of-Life Costs (decommissioning, disposal, data migration, resale value), and Intangible and Opportunity Costs (downtime, security risks, lost opportunity, brand reputation).

Calculating TCO involves a systematic approach starting with defining the asset and its projected lifecycle, then meticulously gathering all data related to its purchase, installation, and ongoing operations. It also requires quantifying indirect costs by assigning monetary values to impacts like lost productivity, and crucially, considering all costs across the asset's entire expected lifespan, often discounting future costs to their present value.